Chapter 9. Divorce, Annulment, Separation, Support, Etc.

§ 16–901. Definitions.

For the purposes of this chapter, the term:

(1) “Cash medical support” means an amount ordered to be paid toward the cost of health insurance provided by a public entity or by another parent, through employment or otherwise, or for extraordinary medical expenses as defined in § 16-916(j)(1) [§ 16-916.01(j)(1)], or for other medical costs not covered by insurance.

(2) “Court” means the Superior Court of the District of Columbia.

(3) “Domestic partner” shall have the same meaning as provided in § 32-701(3).

(4) “Domestic partnership” shall have the same meaning as provided in § 32-701(4).

(5) “IV-D agency” means the organizational unit of the District government, or any successor organizational unit, that is responsible for administering or supervising the administration of the District’s State Plan under title IV, part D, of the Social Security Act, approved January 4, 1975 (88 Stat. 2351; 42 U.S.C. § 651 et seq.), pertaining to parent locator services, paternity establishment, and the establishment, modification, and enforcement of support orders.

(6) “IV-D case” means a case in which the IV-D agency provides services for the purpose of establishing paternity or establishing, modifying, or enforcing a child support obligation.

(6A) “Gender identity or expression” shall have the same meaning as provided in § 2-1401.02(12A).

(7) “Health insurance coverage” means benefits consisting of amounts paid for the diagnosis, cure, mitigation, treatment, or prevention of disease, or amounts paid for the purpose of affecting any structure or function of the body (provided directly, through insurance or reimbursement, or otherwise, and includes items and services) under any hospital or medical service policy or certificate, hospital, or medical service plan contract, or health maintenance organization contract offered by a health insurer that is available to either parent, under which medical services could be provided to a dependent child.

(8) “Support order” means a judgment, decree, or order, whether temporary, final, or subject to modification, issued by a court or an administrative agency of competent jurisdiction, for the support and maintenance of a child, including a child who has attained the age of majority under the law of the issuing state, or a child and the parent with whom the child is living, which provides for monetary support, health care, arrearages, or reimbursement and which may include related costs and fees, interest and penalties, income withholding, attorneys’ fees, and other relief.

§ 16–902. Residency requirements.

(a) Except as provided in subsection (b) of this section, no action for divorce or legal separation shall be maintainable unless one of the parties to the marriage has been a bona fide resident of the District of Columbia for at least 6 months next preceding the commencement of the action.

(b)(1) An action for divorce or legal separation by persons of the same gender, even if neither party to the marriage is a bona fide resident of the District of Columbia at the time the action is commenced, shall be maintainable if the following apply:

(A) The marriage was performed in the District of Columbia; and

(B) Neither party to the marriage resides in a jurisdiction that will maintain an action for divorce or legal separation.

(2) It shall be a rebuttable presumption that a jurisdiction will not maintain an action for divorce or legal separation if the jurisdiction does not recognize the marriage.

(3) Any action for divorce or legal separation as provided by this subsection, including any accompanying petition for alimony, assignment and equitable distribution of property, pendente lite relief, or child custody determination if the District has jurisdiction under § 16-4602.01 or § 16-4602.03, shall be adjudicated in accordance with the laws of the District of Columbia.

(c) No action for annulment of a marriage performed outside the District of Columbia or for affirmance of any marriage shall be maintainable unless one of the parties is a bona fide resident of the District of Columbia at the time of the commencement of the action.

(d) The residence of the parties to an action for annulment of a marriage performed in the District of Columbia shall not be considered in determining whether the action shall be maintainable.

(e) If a member of the armed forces of the United States resides in the District of Columbia for a continuous period of 6 months during his or her period of military service, he or she shall be deemed to reside in the District of Columbia for purposes of this section only.

§ 16–903. Decree annulling marriage.

A decree annulling the marriage as illegal and void may be rendered on any of the grounds specified by sections 46-401.01 and 46-403 as invalidating a marriage.

§ 16–904. Grounds for divorce, legal separation, and annulment.

(a) A divorce from the bonds of marriage may be granted upon the assertion by one or both parties that they no longer wish to remain married.

(b) A legal separation from bed and board may be granted upon at least one party's assertion that they intend to pursue a separate life without obtaining a divorce.

(c) [Repealed].

(d) Marriage contracts may be annulled in the following cases:

(1) where such marriage was contracted while either of the parties thereto had a former spouse living, unless the former marriage had been lawfully dissolved;

(2) where such marriage was contracted during the insanity of either party (unless there has been voluntary cohabitation after the discovery of the insanity);

(3) where such marriage was procured by fraud or coercion;

(4) where either party was matrimonially incapacitated at the time of marriage without the knowledge of the other and has continued to be so incapacitated; or

(5) where either of the parties had not attained the age of legal consent to the contract of marriage (unless there has been voluntary cohabitation after attaining the age of legal consent), but in such cases only at the suit of the party who had not attained such age.

(e) Domestic partnerships registered under § 32-702(a) or relationships recognized under § 32-702(i) may be terminated by judicial decree or judgment.

§ 16–905. Revocation and enlargement of decree of legal separation.

(a) The court may revoke its decree of legal separation at any time, upon the joint application of the parties to be discharged from the operation of the decree.

(b) The court may enlarge its decree of legal separation to an absolute divorce upon application of the party to whom the decree of legal separation was granted, a copy of which application shall be duly served upon the adverse party, if the court finds on the basis of affidavits that no reconciliation has taken place or is probable and that a separation has continued voluntarily and without interruption for a six-month period or without interruption for a period of one year.

§ 16–906. Causes for absolute divorce arising after decree for separation.

Where a legal separation has been decreed the court may afterwards decree an absolute divorce between the parties for any cause arising since the first decree and sufficient to entitle the complaining party to the second decree.

§ 16–907. Parent and child relationship defined.

(a) The term “legitimate” or “legitimated” means that the parent-child relationship exists for all rights, privileges, duties, and obligations under the laws of the District of Columbia.

(b) The term “born out of wedlock” solely describes the circumstances that a child has been born to parents who, at the time of its birth, were not married to each other. The term “born in wedlock” solely describes the circumstances that a child has been born to parents who, at the time of its birth, were married to each other.

(c) A child born to parents in a domestic partnership shall be treated for all legal purposes as a child born in wedlock. For the purposes of this subsection, the term “domestic partnership” shall have the same meaning as provided in § 32-701(4), but shall exclude a domestic partnership where a domestic partner is the parent, grandparent, sibling, child, grandchild, niece, nephew, aunt, or uncle of a woman who gives birth to a child.

§ 16–908. Relationship not dependent on marriage or domestic partnership.

A child is the legitimate child of any parent under which a parent-child relationship is established pursuant to § 16-909, and is the legitimate relative of its parents’ relatives by blood or adoption and entitled to all rights, privileges, duties, and obligations under the laws of the District of Columbia.

§ 16–909. Proof of child’s relationship to parents.

(a) A father-child relationship is established by an adjudication of a man’s parentage, by operation of subsection (e) of this section, or by an unrebutted presumption pursuant to this subsection. There shall be a presumption that a man is the father of a child:

(1) If he and the child’s mother are or have been married, or in a domestic partnership, at the time of either conception or birth, or between conception and birth, and the child is born during the marriage or domestic partnership, or within 300 days after the termination of marital cohabitation by reason of death, annulment, divorce, or separation ordered by a court, or within 300 days after the termination of the domestic partnership pursuant to § 32-702(d) or § 16-904(e); or

(2) If, prior to the child’s birth, he and the child’s mother have attempted to marry, and some form of marriage has been performed in apparent compliance with law, though such attempted marriage is or might be declared void for any reason, and the child is born during such attempted marriage, or within 300 days after the termination of such attempted marital cohabitation by reason of death, annulment, divorce, or separation ordered by a court; or

(3) If, after the child’s birth, he and the child’s mother marry or attempt to marry, (with the attempt involving some form of marriage ceremony that has been performed in apparent compliance with law), though such attempted marriage is or might be declared void for any reason, and he has acknowledged the child to be his; or

(4) If the putative father has acknowledged paternity in writing.

(a-1)(1) A mother-child relationship is established by a woman having given birth to a child, by an adjudication of a woman’s parentage, by operation of subsection (e) of this section, or by an unrebutted presumption pursuant to paragraph (2) of this subsection.

(2) There shall be a presumption that a woman is the mother of a child if she and the child’s mother are or have been married, or in a domestic partnership, at the time of either conception or birth, or between conception or birth, and the child is born during the marriage or domestic partnership, or within 300 days after the termination of marital cohabitation by reason of death, annulment, divorce, or separation ordered by a court, or within 300 days after the termination of the domestic partnership pursuant to § 32-702(d) or § 16-904(e).

(b)(1) A presumption created by subsection (a)(1) through (4) of this section may be overcome upon proof by clear and convincing evidence, in a proceeding instituted within the time provided in § 16-2342(c) or (d), that the presumed parent is not the child’s genetic parent. The Court shall try the question of parentage, and may determine that the presumed parent is the child’s parent, notwithstanding evidence that the presumed parent is not the child’s genetic parent, after giving due consideration to:

(A) Whether the conduct of the mother or the presumed parent should preclude that party from denying parentage;

(B) The child’s interests; and

(C) The duration and stability of the relationship between the child, the presumed parent, and the genetic parent.

(2) If questioned, the presumption created by subsection (a-1)(2) that a child born to the mother is the child of the mother’s female domestic partner or spouse may be overcome pursuant to paragraph (1) of this subsection or upon proof by clear and convincing evidence that the presumed parent did not hold herself out as a parent of the child.

(3) Notwithstanding any other provision in this title, when a child has both a presumed parent and a parent established by a voluntary acknowledgment of paternity, pursuant to § 16-909.01(a)(1), the Court shall determine parentage after giving due consideration to the child’s interests and the duration and stability of the relationship between the child, the presumed parent, and the acknowledged parent.

(b-1) When a child has no presumed parent pursuant to subsection (a)(1) through (4) of this section or pursuant to subsection (a-1)(2) of this section, a conclusive presumption of parentage shall be created:

(1) Upon a result and an affidavit from a laboratory of a genetic test of a type generally acknowledged as reliable by accreditation bodies designated by the Secretary of the U.S. Department of Health and Human Services that is performed by a laboratory approved by such a body indicating a 99% probability that the person is the genetic parent of the child; or

(2) If the father has acknowledged paternity in writing in the District, as provided in § 16-909.01(a)(1), unless it is proven that the requirements of that section were not fully met.

(b-2)(1) Subject to the requirements of this section, the court may issue a judgment adjudicating the parentage of a child born to parents who reside outside of the District of Columbia in a proceeding to determine parentage, pursuant to § 16-2342, if:

(A) The child was born in the District of Columbia;

(B) Both individuals seeking a judgment adjudicating parentage have a legal relationship with the child through a presumption of parentage under this section or meet the requirements of parentage in subsection (e) of this section; and

(C) Both parents submit to the jurisdiction of the District by consent in a record, by entering a general appearance, or by filing a responsive document having the effect of waiving any contest to personal jurisdiction.

(2) Upon the determination of parentage under this subsection, the court shall issue a judgment adjudicating the parentage of the child.

(3) This subsection shall apply retroactively to all children born in the District of Columbia on or after July 18, 2009.

(c) The parent-child relationship shall be conclusively established:

(1) Upon a determination of the parentage of a child by the following:

(A) The Superior Court of the District of Columbia under the provisions of subchapter II of Chapter 23 of this title or subsection (b) of this section;

(B) Any other court of competent jurisdiction;

(C) The IV-D agency of another state, in compliance with jurisdictional and procedural requirements of that state; or

(D) Any entity of another state authorized to determine parentage, in compliance with jurisdictional and procedural requirements of that state;

(2) When a child has no presumed parent pursuant to subsection (a)(1) through (4) of this section or pursuant to subsection (a-1)(2) of this section, by a voluntary acknowledgment of paternity pursuant to section 16-909.01(a)(1), unless either signatory rescinds the acknowledgment pursuant to section 16-909.01(a-1); or

(3) By a voluntary acknowledgment of paternity in another state pursuant to the laws and procedures of that state, unless either signatory rescinds the acknowledgment pursuant to the laws and procedures of that state.

(c-1)(1) A parent-child relationship that has been established in the District pursuant to subsection (b-1)(1) of this section may be challenged upon the same grounds and through the same procedures as are applicable to a final judgment of the Court.

(2)(A) A parent-child relationship that has been established in the District pursuant to subsection (b-1)(2) of this section or § 16-909.01(a)(1) may be challenged in the Court after the recission period provided by § 16-909.01(a-l) through the same procedures as are applicable to a final judgment of the Court, but only on the basis of fraud, duress, or a material mistake of fact, with the burden of proof on the challenging party. A challenge to the acknowledgement may be filed with the Court at any time by a party, any signatory to an acknowledgement of paternity or adjudication, the child whose parentage is at issue, or another individual who puts forth sufficient facts to claim they may be the biological parent of the child.

(B) For the purposes of subparagraph (2)(A) of this paragraph, Court-ordered DNA test results excluding a signatory of an acknowledgement of paternity as the father or proving to a scientific certainty that a different individual is the child's biological parent shall constitute evidence of fraud, duress, or a material mistake of fact, and shall require the Court to set aside the acknowledgement of paternity.

(C) The legal responsibilities (including child support obligations) of any signatory arising from the acknowledgement of paternity may not be suspended during the challenge, except for good cause shown.

(c-2) A determination of parentage made pursuant to subsection (c)(l)(A) of this section may be challenged in the same manner as an acknowledgement of paternity may be challenged pursuant to subsection (c-1)(2) of this section.

(d) The parent-child relationship between an adoptive parent and a child may be established conclusively by proof of adoption.

(e)(1) A person who consents to the artificial insemination of a woman as provided in subparagraph (A) or (B) of this paragraph with the intent to be the parent of her child, is conclusively established as a parent of the resulting child.

(A) Consent by a woman, and a person who intends to be a parent of a child born to the woman by artificial insemination, shall be in writing signed by the woman and the intended parent.

(B) Failure of a person to sign a consent required by subparagraph (A) of this paragraph, before or after the birth of the child, shall not preclude a finding of intent to be a parent of the child if the woman and the person resided together in the same household with the child and openly held the child out as their own.

(2) A donor of semen to a person for artificial insemination, other than the donor’s spouse or domestic partner, is not a parent of a child thereby conceived unless the donor and the person agree in writing that said donor shall be a parent. Notwithstanding any other provision in this title, genetic test results shall not establish parentage of a semen donor unless:

(A) The donor of semen is the spouse or domestic partner of the child’s mother; or

(B) The donor and the child’s mother agree in writing that said donor shall be a parent.

(f) For the purposes of this section, the term:

(1) “Domestic partner” shall have the same meaning as provided in § 32-701(3), but shall exclude a domestic partner who is the parent, grandparent, sibling, child, grandchild, niece, nephew, aunt, or uncle of a woman who gives birth to a child.

(2) “Domestic partnership” shall have the same meaning as provided in § 32-701(4), but shall exclude a domestic partnership where a domestic partner is the parent, grandparent, sibling, child, grandchild, niece, nephew, aunt, or uncle of a woman who gives birth to a child.

§ 16–909.01. Establishment of paternity by voluntary acknowledgment and based on genetic test results.

(a) Paternity may be established by:

(1)(A) A written statement of the father and mother signed in the District under oath (which may include signature in the presence of a notary) that acknowledges paternity; provided, that before the parents sign the acknowledgment, both have been given written and oral notice of the alternatives to, legal consequences of, and the rights and responsibilities that arise from signing the acknowledgment. Oral notice may be given through videotape or audiotape.

(B) The acknowledgment shall include the full name, the social security number, the date of birth of the mother, father, and child, the addresses of the mother and father, the birthplace of the child, an explanation of the legal consequences of the affidavit, a statement indicating that both parents understand their rights, responsibilities, and the alternatives and consequences of signing the affidavit, the place the affidavit was completed, signature lines for the parents, and any other data elements required by federal law.

(C) Nothing in this paragraph shall affect the validity of a voluntary acknowledgment of paternity executed before December 23, 1997, or preclude the submission of an acknowledgment of paternity that does not comply with the requirements of this paragraph as evidence of paternity in a judicial or administrative proceeding.

(D) An acknowledgement signed in the District shall establish paternity pursuant to § 16-909(b-1)(2) unless it is proven that the requirements of this paragraph were not fully met; or

(2) A result and an affidavit from a laboratory of a genetic test of a type generally acknowledged as reliable by accreditation bodies designated by the Secretary of the U.S. Department of Health and Human Services that is performed by a laboratory approved by such a body, that affirms at least a 99% probability that the putative father is the father of the child.

(a-1) A signatory to a voluntary acknowledgment of paternity pursuant to subsection (a)(1) of this section may rescind the acknowledgment within the earlier of 60 days or the date of an administrative or judicial proceeding relating to the child in which the signatory is a party.

(b) When a child has no presumed parent pursuant to § 16-909(a)(1) through (4) or § 16-909(a-1)(2), an acknowledgment in accordance with subsection (a)(1) of this section, which has not been rescinded pursuant to subsection (a-1) of this section, or a genetic test and affidavit that meet the requirements of subsection (a)(2) of this section shall legally establish the parent-child relationship between the father and the child for all rights, privileges, duties, and obligations under the laws of the District of Columbia. The acknowledgment or genetic test and affidavit shall be admissible as evidence of paternity.

(c) A public or private agency or institution that operates in the District of Columbia shall accept as adequate proof of paternity a birth certificate issued by the District of Columbia after the effective date of the District of Columbia Paternity Establishment Temporary Act of 1991 [June 18, 1991] or other evidence that the requirements of subsection (a)(1) or (a)(2) of this section have occurred.

(d) If a child has a presumed parent, in the absence of an acknowledgment, or if the probability of paternity shown by a genetic test is less than 99%, paternity may be established as otherwise provided in this chapter.

§ 16–909.02. Full faith and credit to parentage determinations by other states.

The District of Columbia government shall give full faith and credit to the determinations of parentage made by other states, whether established through voluntary acknowledgment or through an administrative or judicial process.

§ 16–909.03. Voluntary paternity acknowledgment program for birthing hospitals.

(a) For the purposes of this section, the term “birthing hospital” means a hospital that has an obstetric care unit or provides obstetric services, or a birthing center.

(b)(1) Each public and private birthing hospital in the District of Columbia shall operate a program that, immediately before and after the birth of a child, provides to each unmarried woman who gives birth at the hospital and the alleged putative father, if present in the hospital:

(A) Written materials concerning paternity establishment;

(B) Forms necessary to acknowledge paternity voluntarily that meet the federal requirements;

(C) A written and oral description (the oral description may be videotaped or audiotaped) of the alternatives to, the legal consequences of, and the rights and responsibilities that arise from, signing a voluntary acknowledgment of paternity;

(D) Written notice that a voluntary acknowledgment of paternity is not effectuated unless the mother and putative father each signs the form under oath and a notary authenticates the signatures;

(E) The opportunity to speak, either by telephone or in person, with hospital or IV-D agency staff who are trained to clarify information and answer questions about paternity establishment;

(F) Access to the services of a notary on the premises of the birthing hospital; and

(G) The opportunity to acknowledge paternity voluntarily in the hospital.

(2) The Mayor shall provide to each birthing hospital the materials described in paragraph (1)(A) through (D) of this subsection, in sufficient amounts to be distributed to each unmarried mother giving birth in the hospital and to each putative father present in the hospital.

(c) The birthing hospital shall transmit each completed voluntary acknowledgment of paternity form to the Registrar of Vital Records within 14 days of completion. The Registrar shall promptly record identifying information from the form and permit the IV-D agency timely access to the identifying information and any other documentation recorded from the form that the IV-D agency needs to determine if a voluntary acknowledgment of paternity has been recorded and to seek a support order on the basis of the recorded voluntary acknowledgment of paternity.

(d) The Mayor shall provide to the staff of each birthing hospital training, guidance, and written instructions necessary to operate the paternity acknowledgment program required by this section.

(e) The Mayor shall assess the program of each birthing hospital each year.

§ 16–909.04. Voluntary paternity acknowledgment program for birth records agency.

(a) The Registrar of Vital Records shall offer to any person seeking to file or amend a birth certificate that does not include the names of 2 parents:

(1) Written materials concerning paternity establishment;

(2) Forms necessary to acknowledge paternity voluntarily that meet the federal requirements;

(3) A written and oral description of the alternatives to, the legal consequences of, and the rights and responsibilities that arise from, signing a voluntary acknowledgment of paternity (the oral description may be videotaped or audiotaped);

(4) Written notice that a voluntary acknowledgment of paternity is not effectuated unless the mother and putative father each signs the form under oath and a notary authenticates the signatures;

(5) The services of a notary on the premises;

(6) The opportunity to speak, by telephone or in person, with staff of the IV-D agency or Registrar who are trained to clarify information and answer questions about paternity establishment; and

(7) The opportunity to acknowledge paternity voluntarily at the birth records agency.

(b) The Registrar of Vital Records shall establish procedures for the recording in the records of the Registrar, and for the transmittal to the IV-D agency of completed voluntary acknowledgments of paternity, and of information contained in an acknowledgment that may be used in the establishment or enforcement of a support order.

§ 16–909.05. Mayor authorized to designate other sites for paternity acknowledgment program.

The Mayor is authorized to establish voluntary paternity establishment services at entities other than hospitals, or the Vital Records Office, by publishing a notice of such location in the D.C. Register. The Mayor may only designate entities that meet the applicable federal requirements and comply with the same requirements that apply to birthing hospitals as set forth in section 16-909.03 .

§ 16–910. Assignment and equitable distribution of property.

(a) Upon entry of a final decree of legal separation, annulment, or divorce, or upon the termination of a domestic partnership pursuant to § 32-702(d) or § 16-904(e) and the filing of a petition for relief available under this section, in the absence of a valid antenuptial or postnuptial agreement resolving all issues related to the property of the parties, the court shall:

(1) Assign to each party the party's sole and separate property acquired prior to the marriage or domestic partnership, and the party's sole and separate property acquired during the marriage or domestic partnership by gift, bequest, devise, or descent, and any increase thereof, or property acquired in exchange therefore;

(2) Value and distribute all other property and debt accumulated during the marriage or domestic partnership that has not been addressed in a valid antenuptial or postnuptial agreement or a decree of legal separation, regardless of whether title is held individually or by the parties in a form of joint tenancy or tenancy by the entireties, in a manner that is equitable, just, and reasonable, after considering all relevant factors, including:

(A) The duration of the marriage or domestic partnership;

(B) The age, health, occupation, amount, and sources of income, vocational skills, employability, assets, debts, and needs of each of the parties;

(C) Provisions for the custody of minor children;

(D) Whether the distribution is in lieu of or in addition to alimony;

(E) Each party's obligation from a prior marriage, a prior domestic partnership, or for other children;

(F) The opportunity of each party for future acquisition of assets and income;

(G) Each party's contribution as a homemaker or otherwise to the family unit;

(H) Each party's contribution to the education of the other party, which enhanced the other party's earning ability;

(I) Each party's increase or decrease in income as a result of the marriage, the domestic partnership, or duties of homemaking and child care;

(J) Each party's contribution to the acquisition, preservation, appreciation, dissipation, or depreciation in value of the assets that are subject to distribution, the taxability of these assets, and whether the asset was acquired or the debt incurred after separation;

(K) The effects of taxation on the value of the assets subject to distribution; and

(L) The circumstances that contributed to the estrangement of the parties, including the history of physical, emotional, or financial abuse by one party against the other; and

(3)(A) At the request of a party to proceedings for dissolution of marriage or for legal separation of the parties, enter an order, prior to the final determination of ownership of a pet animal, to require a party to care for the pet animal. The existence of an order providing for the care of a pet animal during the course of proceedings for dissolution of marriage or for legal separation of the parties shall not have any impact on the court's final determination of ownership of the pet animal.

(B) The court, at the request of a party to proceedings for dissolution of marriage or for legal separation of the parties, may assign sole or joint ownership of a pet animal, taking into consideration the care and best interest of the pet animal.

(b) For the purposes of this section, the term "pet animal" means any animal that is community property and kept as a household pet.

(c) The Court is not required to value a pension or annuity if it enters an order distributing future periodic payments.

§ 16–911. Pendente lite relief.

(a) During the pendency of an action for legal separation, divorce, the termination of a domestic partnership pursuant to § 32-702(d) or § 16-904(e), where one of the domestic partners has filed a petition for relief available under this section, or an action by a spouse to declare the marriage null and void, where the nullity is denied by the other spouse, the court may:

(1) require the spouse or domestic partner to pay pendente lite alimony to the other spouse or domestic partner; require one party to pay pendente lite child support, including health insurance coverage, cash medical support, or both, for his or her minor children committed to another party’s care; and require the spouse or domestic partner to pay suit money, including counsel fees, to enable such other spouse to conduct the case. The Court may enforce any such order by attachment, garnishment, or imprisonment for disobedience, and all support orders shall be enforceable by withholding as provided in § 46-207 and § 46-251.07. In determining pendente lite alimony for a spouse or domestic partner, the Court shall consider the factors set forth in § 16-913(d) and may make an award of pendente lite alimony retroactive to the date of the filing of the pleading that requests alimony.

(2) enjoin any disposition of a spouse’s or domestic partner’s property to avoid the collection of the allowances so required;

(3) if a spouse or domestic partner fails or refuses to pay the alimony or suit money, sequestrate his or her property and apply the income thereof to such objects;

(4) if a party under court order to make payments under this section is in arrears, order the party to make an assignment of part of his or her salary, wages, earnings or other income to the person entitled to receive the payments;

(5) determine, in accordance with section 16-914, the care and custody of a minor child or children pending final determination of those issues; and

(6) award exclusive use of the family home or any other dwelling unit which is available for use as a residence pendente lite to either of the parties as is just, equitable, and reasonable, after consideration of all relevant factors, without regard to the respective interests of the parties in the property.

(a-1) Repealed.

(a-2) Repealed.

(b) The attachment, garnishment, or assignment under paragraphs (1) and (4) of subsection (a) is binding on the employer, trustee, or other payor of salary, wages, earnings, or other income. No employer shall discharge or otherwise discipline an employee because of such attachment, garnishment, or assignment.

(c) The court may order, at any time, that maintenance or support payments be made to the Collection and Disbursement Unit, as defined in section 46-201(2A) [now § 46-201(3)], for remittance to the person entitled to receive the payments, and shall order that such payments be made to the Collection and Disbursement Unit when the Collection and Disbursement Unit is responsible for collecting and disbursing these payments under section 46-202.01.

(d) The Court may order any other appropriate pendente lite relief.

§ 16–912. Permanent alimony; enforcement. [Repealed]

Repealed.

§ 16–913. Alimony.

(a) When a divorce or legal separation is granted, or when a termination of a domestic partnership becomes effective under § 32-702(d) or § 16-904(e) and one partner has filed a petition for relief available under this section, the Court may require either party to pay alimony to the other party if it seems just and proper.

(b) The award of alimony may be indefinite or term-limited and structured as appropriate to the facts. The Court shall determine the amount and the time period for the award of alimony.

(c) An award of alimony may be retroactive to the date of the filing of the pleading that requests alimony.

(d) In making an award of alimony, the Court shall consider all the relevant factors necessary for a fair and equitable award, including, but not limited to, the:

(1) ability of the party seeking alimony to be wholly or partly self-supporting;

(2) time necessary for the party seeking alimony to gain sufficient education or training to enable that party to secure suitable employment;

(3) standard of living that the parties established during their marriage or domestic partnership, but giving consideration to the fact that there will be 2 households to maintain;

(4) duration of the marriage or domestic partnership;

(5) circumstances which contributed to the estrangement of the parties, including the history of physical, emotional or financial abuse by one party against the other;

(6) age of each party;

(7) physical and mental condition of each party;

(8) ability of the party from whom alimony is sought to meet his or her needs while meeting the needs of the other party; and

(9) financial needs and financial resources of each party, including:

(A) income;

(B) income from assets, both those that are the property of the marriage or domestic partnership and those that are not;

(C) potential income which may be imputed to non-income producing assets of a party;

(D) any previous award of child support in this case;

(E) the financial obligations of each party;

(F) the right of a party to receive retirement benefits; and

(G) the taxability or non-taxability of income.

§ 16–914. Custody of children.

(a)(1)(A) In any proceeding between parents in which the custody of a child is raised as an issue, the best interest of the child shall be the primary consideration. The race, color, national origin, political affiliation, sex, sexual orientation, or gender identity or expression of a party, in and of itself, shall not be a conclusive consideration. The Court shall make a determination as to the legal custody and the physical custody of a child. A custody order may include:

(i) sole legal custody;

(ii) sole physical custody;

(iii) joint legal custody;

(iv) joint physical custody; or

(v) any other custody arrangement the Court may determine is in the best interest of the child.

(B) For the purposes of this paragraph, the term:

(i) “Legal custody” means legal responsibility for a child. The term “legal custody” includes the right to make decisions regarding that child’s health, education, and general welfare, the right to access the child’s educational, medical, psychological, dental, or other records, and the right to speak with and obtain information regarding the child from school officials, health care providers, counselors, or other persons interacting with the child.

(ii) “Physical custody” means a child’s living arrangements. The term “physical custody” includes a child’s residency or visitation schedule.

(2) Unless the court determines that it is not in the best interest of the child, the court may issue an order that provides for frequent and continuing contact between each parent and the minor child or children and for the sharing of responsibilities of child-rearing and encouraging the love, affection, and contact between the minor child or children and the parents regardless of marital status. There shall be a rebuttable presumption that joint custody is in the best interest of the child or children, except in instances where a judicial officer has found by a preponderance of the evidence that an intrafamily offense as defined in § 16-1001(8), an instance of child abuse as defined in section 102 of the Prevention of Child Abuse and Neglect Act of 1977, effective September 23, 1977 (D.C. Law 2-22; D.C. Official Code § 4-1301.02), an instance of child neglect as defined in section 2 of the Child Abuse and Neglect Prevention Children’s Trust Fund Act of 1993, effective October 5, 1993 (D.C. Law 10-56; D.C. Official Code § 4-1341.01), or where parental kidnapping as defined in D.C. Official Code section 16-1021 through section 16-1026 has occurred. There shall be a rebuttable presumption that joint custody is not in the best interest of the child or children if a judicial officer finds by a preponderance of the evidence that an intrafamily offense as defined in § 16-1001(8), an instance of child abuse as defined in section 102 of the Prevention of Child Abuse and Neglect Act of 1977, effective September 23, 1977 (D.C. Law 2-22; D.C. Official Code § 4-1301.02), an instance of child neglect as defined in section 2 of the Child Abuse and Neglect Prevention Children’s Trust Fund Act of 1993, effective October 5, 1993 (D.C. Law 10-56; D.C. Official Code § 4-1341.01), or where parental kidnapping as defined in D.C. Official Code section 16-1021 through section 16-1026 has occurred.

(3) In determining the care and custody of a child, the best interest of the child shall be the primary consideration. To determine the best interest of the child, the court shall consider all relevant factors, including, but not limited to:

(A) the wishes of the child as to his or her custodian, where practicable;

(B) the wishes of the child’s parent or parents as to the child’s custody;

(C) the interaction and interrelationship of the child with his or her parent or parents, his or her siblings, and any other person who may emotionally or psychologically affect the child’s best interest;

(D) the child’s adjustment to his or her home, school, and community;

(E) the mental and physical health of all individuals involved;

(F) evidence of an intrafamily offense as defined in § 16-1001(8);

(G) the capacity of the parents to communicate and reach shared decisions affecting the child’s welfare;

(H) the willingness of the parents to share custody;

(I) the prior involvement of each parent in the child’s life;

(J) the potential disruption of the child’s social and school life;

(K) the geographic proximity of the parental homes as this relates to the practical considerations of the child’s residential schedule;

(L) the demands of parental employment;

(M) the age and number of children;

(N) the sincerity of each parent’s request;

(O) the parent’s ability to financially support a joint custody arrangement;

(P) the impact on Temporary Assistance for Needy Families, or Program on Work, Employment, and Responsibilities, and medical assistance; and

(Q) the benefit to the parents.

(a-1) For the purposes of this section, if the judicial officer finds by a preponderance of evidence that a contestant for custody has committed an intrafamily offense, any determination that custody or visitation is to be granted to the abusive parent shall be supported by a written statement by the judicial officer specifying factors and findings which support that determination. In determining visitation arrangements, if the judicial officer finds that an intrafamily offense has occurred, the judicial officer shall only award visitation if the judicial officer finds that the child and custodial parent can be adequately protected from harm inflicted by the other party. The party found to have committed an intrafamily offense has the burden of proving that visitation will not endanger the child or significantly impair the child’s emotional development.

(a-2) Repealed.

(a-3)(1) A minor parent, or the parent, guardian, or other legal representative of a minor parent on the minor parent’s behalf, may initiate a custody proceeding under this chapter.

(2) For the purposes of this subsection, the term “minor” means a person under 18 years of age.

(b) Notice of a custody proceeding shall be given to the child’s parents, guardian, or other custodian. The court, upon a showing of good cause, may permit intervention by any interested party.

(c) In any custody proceeding under this chapter, the Court may order each parent to submit a detailed parenting plan which shall delineate each parent’s position with respect to the scheduling and allocation of rights and responsibilities that will best serve the interest of the minor child or children. The parenting plan may include, but shall not be limited to, provisions for:

(1) the residence of the child or children;

(2) the financial support based on the needs of the child and the actual resources of the parent;

(3) visitation;

(4) holidays, birthdays, and vacation visitation;

(5) transportation of the child between the residences;

(6) education;

(7) religious training, if any;

(8) access to the child’s educational, medical, psychiatric, and dental treatment records;

(9) except in emergencies, the responsibility for medical, psychiatric, and dental treatment decisions;

(10) communication between the child and the parents; and

(11) the resolution of conflict, such as a recognized family counseling or mediation service, before application to the Court to resolve a conflict.

(d) In making its custody determination, the Court:

(1) shall consider the parenting plans submitted by the parents in evaluating the factors set forth in subsection (a)(3) of this section in fashioning a custody order;

(2) shall designate the parent(s) who will make the major decisions concerning the health, safety, and welfare of the child that need immediate attention; and

(3) may order either or both parents to attend parenting classes.

(e) Joint custody shall not eliminate the responsibility for child support in accordance with the applicable child support guideline as set forth in § 16-916.01.

(f)(1) An award of custody may be modified or terminated upon the motion of one or both parents, or on the Court’s own motion, upon a determination that there has been a substantial and material change in circumstances and that the modification or termination is in the best interest of the child.

(2) When a motion to modify custody is filed, the burden of proof is on the party seeking a change, and the standard of proof shall be by a preponderance of the evidence.

(3) The provisions of this chapter shall apply to motions to modify or terminate any award of custody filed after April 18, 1996.

(g) The Court, for good cause and upon its own motion, may appoint a guardian ad litem or an attorney, or both, to represent the minor child’s interests.

(h) The Court shall enter an order for any custody arrangement that is agreed to by both parents unless clear and convincing evidence indicates that the arrangement is not in the best interest of the minor child.

(i) An objection by one parent to any custody arrangement shall not be the sole basis for refusing the entry of an order that the Court determines is in the best interest of the minor child.

(j) The Court shall place on the record the specific factors and findings which justify any custody arrangement not agreed to by both parents.

(k) Notwithstanding any other provision of this section, no person shall be granted legal custody or physical custody of, or visitation with, a child if the person has been convicted of first degree sexual abuse, second degree sexual abuse, or child sexual abuse, and the child was conceived as a result of that violation. Nothing in this subsection shall be construed as abrogating or limiting the responsibility of a person described herein to pay child support.

§ 16–914.01. Retention of jurisdiction as to alimony, custody of children, and child support.

After the issuance of a judgment, decree, or order granting custody, child support, or alimony, the Court retains jurisdiction for the entry of future orders modifying or terminating the initial judgment, decree, or order to the extent the retention of jurisdiction does not contravene other statutory provisions.

§ 16–914.02. Child custody and visitation rights of parents during deployment for military service.

(a)(1) A deploying parent may file a motion with the court to request an expedited hearing for the purpose of obtaining a temporary child custody or visitation order when no court order exists as to the custody or visitation of the child of the deploying parent.

(2) A deploying parent, or a non-deploying parent where the deploying parent is currently on deployment or has received a deployment order, may file a motion with the court to request a temporary child custody or visitation order modifying the terms of an existing child custody order or visitation order.

(b)(1) Upon a motion as provided under subsection (a) of this section, the court may issue a temporary order to establish the terms for custody and visitation of the child of the deploying parent or modify the terms of an existing custody or visitation order for the child of the deploying parent to make reasonable accommodation for the deployment.

(2) A temporary order issued pursuant to this subsection shall state:

(A) That the basis of the order is the deployment of a military parent; and

(B) That the temporary order shall terminate and the permanent order shall resume within 10 days after notification of the deploying parent’s ability to resume custody or visitation unless the court finds that resumption of the custody or visitation order in effect before deployment is no longer in the child’s best interest.

(3) A temporary order issued pursuant to this subsection may require:

(A) The non-deploying parent to reasonably accommodate the leave schedule of the deploying parent;

(B) The non-deploying parent to facilitate opportunities for telephonic communication, electronic mail, or other electronic communication between the deploying parent and child during the deployment period; and

(C) The deploying parent to provide the non-deploying parent with timely notice of leave of absence, unless the leave schedule of the deploying parent is changed without sufficient advance notice to allow the deploying parent to give timely notice to the non-deploying parent, in which case neither the court nor the non-deploying parent shall use the untimely notice to prevent contact between the deploying parent and the child or use the untimely notice as a basis in requesting or issuing a permanent order modifying an existing custody or visitation arrangement.

(4)(A) Upon a motion of a deploying parent, or upon motion of a family member of the deploying parent with the consent of the deploying parent, the court may issue a temporary order to delegate all or a portion of the deploying parent’s visitation rights to a family member with a close and substantial relationship to the child for the duration of the deployment if in the best interest of the child; provided, that:

(i) The delegation of visitation rights or access to the child shall not create an entitlement or standing to assert separate rights to a liberty interest in the care and custody of the child for a person other than a parent; and

(ii) A delegation of visitation rights or access to the child shall not exceed the visitation time granted to the deploying parent.

(B) A temporary order delegating all or a portion of a deploying parent’s visitation rights under this paragraph shall terminate by operation of law in accordance with paragraph (2)(B) of this subsection.

(C) A person to whom visitation rights have been delegated by a temporary order issued under this paragraph shall have full legal standing to enforce that temporary order.

(5) In issuing a temporary order under this subsection, the court shall ensure that the parties are advised of the possible availability of a modification of child support, and shall provide notice to the parties of how such a modification may be obtained. The court may also decide the issue of child support, in accordance with the child support guideline in § 16-916.01, during the hearing on the motion for a temporary order under this section.

(6) For the purposes of this subsection, the non-deploying parent shall have the burden of proving that resumption of the permanent order is no longer in the child’s best interest.

(c) The court shall not issue a permanent order modifying the terms of an existing custody or visitation order until 90 days after the termination of the deployment of a military parent. The court shall not consider the activation or deployment of a deploying parent as the sole factor in the court’s decision of whether or not to grant or deny a petition for custody or visitation, and neither deployment nor the potential for future deployment of a military parent shall, by itself, be regarded as a material change in the circumstances of any existing custody or visitation order, or against the best interests of the child, for the court to issue a permanent order modifying the terms of an existing custody or visitation order.

(d) The court, in any child custody or visitation proceeding between either 2 deploying parents or a deploying parent and a non-deploying parent, shall allow any deploying parent to present testimony or evidence relevant to the custody or visitation proceedings either by affidavit or electronically when deployment precludes the personal appearance of the deploying parent.

(e) For the purposes of this section, the term:

(1) “Activation” means the extension of United States Armed Forces to active military service of the United States. Activation does not include National Guard or Reserve annual training, inactive duty, drill weekends, or active duty within the District.

(2) “Deploying parent” means a military parent who is on deployment or has received mandatory orders from military leadership to deploy with the United States Armed Forces.

(3) “Deployment” means the compliance with military orders received by any member of the United States Armed Forces for active service, including service for combat operations, contingency operations, peacekeeping operations, temporary duty, and remote tours of duty.

(4) “Military parent” means a member of the United States Armed Forces who is the parent of a minor child, including the biological, adoptive, or legal parent, whose parental rights have not been terminated or transferred to the District or another person through juvenile proceedings.

(5) “Non-deploying parent” means a parent who is not a member of the United States Armed Forces, or is a military parent who is currently neither a deploying parent nor a parent that has received an imminent deployment or activation order.

(6) “United States Armed Forces” means the United States Army, Navy, Air Force, Marine Corps, Coast Guard, National Guard, or any other Reserve component thereof.

§ 16–915. Change of name on divorce.

Upon divorce from the bond of marriage, the court shall, on request of a party who assumed a new name on marriage and desires to discontinue using it, state in the decree of divorce either the birth-given or other previous name which such person desires to use.

§ 16–916. Maintenance of spouse [or domestic partner] and minor children; maintenance of former spouse [or domestic partner]; maintenance of minor children; enforcement.

(a) Whenever a spouse or domestic partner shall fail or refuse to maintain his or her needy spouse, domestic partner, minor children, or both, although able to do so, or whenever any parent shall fail or refuse to maintain his or her children by a marriage since dissolved, although able to do so, the court, upon proper application and upon a showing of genuine need of a spouse or domestic partner, may decree, pendente lite and permanently, that such spouse or domestic partner shall pay reasonable sums periodically for the support of such needy spouse or domestic partner and of the children, or such children, as the case may be, and the court may decree that he or she pay suit money, including counsel fees, pendente lite and permanently, to enable plaintiff to conduct the case.

(b) Whenever a former spouse or domestic partner has obtained a foreign ex parte divorce or termination of the domestic partnership, in accordance with § 32-702(d) or § 16-904(e), the court thereafter, on application of the other former spouse or domestic partner and with personal service of process upon such former spouse or domestic partner in the District of Columbia, may decree that he or she shall pay him or her reasonable sums periodically for his or her maintenance and for suit money, including counsel fees, pendente lite and permanently, to enable plaintiff to conduct the case.

(c) When a father or mother fails to maintain his or her minor child, the Court may decree that the father or mother pay reasonable sums periodically for the support and maintenance of the child, including health insurance coverage and cash medical support, and may decree that the father or mother pay Court costs, including counsel fees, to enable plaintiff to conduct the cases.

(c-1) A support order entered under this section shall contain terms providing for the payment of medical expenses for each child included in the support order, whether or not health insurance coverage is available to pay for those expenses. The court may order either or both parents to provide health insurance coverage, cash medical support, or both, consistent with § 16-916.01.

(c-2) In all cases where accessible health insurance coverage is available to either or both parents at reasonable cost, the court shall order either or both parents to provide the health insurance coverage, consistent with § 16-916.01.

(c-3) In selecting among health insurance coverage options, the court shall consider, at a minimum, the cost, comprehensiveness, and accessibility of all health insurance coverage options available to either parent.

(c-3A) In cases where accessible health insurance coverage is not available to either parent at reasonable cost, or where the medical expenses of a child are not fully covered by health insurance, the court shall order either or both parents to pay cash medical support consistent with § 16-916.01.

(c-3B) For the purposes of this section, health insurance coverage shall be considered reasonable in cost if the cost to the obligated parent of providing coverage for the children subject to the support order pursuant to § 16-916.01(i)(3) does not exceed 5% of the parent’s gross income.

(c-3C) For the purposes of this section, health insurance coverage shall be considered accessible if, based on the work history of the parent providing the coverage, it will be available for at least one year, and if the child lives within the geographic area covered by the plan or within 30 minutes or 30 miles of primary care services.

(c-4) All support orders subject to enforcement by the IV-D agency pursuant to title IV, part D of the Social Security Act, approved January 4, 1975 (88 Stat. 2351; 42 U.S.C. § 651 et seq.), shall require the payment of support in equal monthly amounts on the first day of each month. If a support order does not require the payment of support in this manner and the support order is or becomes subject to enforcement by the IV-D agency, the IV-D agency may direct the payor, upon notice to both parents, to pay the support in equal monthly amounts on the first day of each month; provided, that the total of the monthly amounts required to be paid in one year cumulatively equals the total support required to be paid annually under the support order.

(d) The court may enforce any decree entered under this section in the same manner as is provided in section 16-911.

(e)(1) In order to secure payment of overdue support as defined in section 466(e) of the Social Security Act approved August 16, 1984 (98 Stat. 1306; 42 U.S.C. 666(e)), after providing notice under subsection (b) of this section, the Court shall, where appropriate, require the parent to post security, bond, or give some other guarantee.

(2) The Court shall provide advance notice to the parent regarding the delinquency of the support payment and the requirement of posting security, bond, or guarantee. The notice shall inform the parent of the parent’s rights and the methods available for contesting the impending action.

(3) Where the Clerk of the Court determines that a parent is delinquent in child support payments in an amount equal to at least 60 days of child support payments, the Clerk of the Court shall notify the Mayor of the parent’s name, social security number, court docket number, and the amount of the support payment delinquency.

(f) Repealed.

§ 16–916.01. Child Support Guideline.

(a) In any case that involves the establishment of child support, or in any case that seeks to modify an existing support order, if the judicial officer finds that there is an existing duty of child support, the judicial officer shall conduct a hearing on child support, make a finding, and enter a judgment in accordance with the child support guideline (“guideline”) established in this section.

(b) In every action for divorce or custody, and in every proceeding for protection involving an intrafamily offense, instituted pursuant to Chapter 10 of Title 16, where a party has a legal duty to pay support to another party, the judicial officer shall inquire into the parties’ child support arrangements. If the party entitled to child support has not requested support, or if the parties have agreed against the entry of a support order, the judicial officer shall advise the parties, regardless of whether they are represented by counsel, of the parties’ entitlement to receive and obligation to pay child support under the guideline.

(c) The guideline shall be based on the following principles:

(1) The guideline shall set forth an equitable approach to child support in which both parents share legal responsibility for the support of the child.

(2) The subsistence needs of each parent shall be taken into account in the determination of child support.

(3) A parent has the responsibility to meet the child’s basic needs, as well as to provide additional child support above the basic needs level.

(4) Application of the guideline shall be gender neutral.

(5) The guideline shall be applied consistently regardless of whether either parent is a Temporary Assistance for Needy Families, Program on Work, Employment, and Responsibility, or General Assistance for Children recipient, or a recipient of benefits under any substantially similar means-tested public assistance program.

(6) The guideline shall be applied presumptively.

(d)(1) For the purposes of this section, the term “gross income” means income from any source, including:

(A) Salary or wages, including overtime, tips, or income from self-employment;

(B) Commissions;

(C) Severance pay;

(D) Royalties;

(E) Bonuses;

(F) Interest or dividends;

(G) Income derived from a business or partnership after deduction of reasonable and necessary business expenses, but not depreciation;

(H) Social Security;

(I) Veteran’s benefits;

(J) Insurance benefits;

(K) Worker’s compensation;

(L) Unemployment compensation;

(M) Pension;

(N) Annuity;

(O) Income from a trust;

(P) Capital gains from a real or personal property transaction, if the capital gains represent a regular source of income;

(Q) A contract that results in regular income;

(R) A perquisite or in-kind compensation if the perquisite or in-kind compensation is significant and represents a regular source of income or reduces living expenses, such as use of a company car , reimbursed meals, or military housing and food allowances, including the Basic Allowance for Housing and the Basic Allowance for Subsistence;

(S) Income from life insurance or an endowment contract;

(T) Regular income from an interest in an estate, directly or through a trust;

(U) Lottery or gambling winnings that are received in a lump sum or in an annuity;

(V) Prize or award;

(W) Net rental income after deduction of reasonable and necessary operating costs, but not depreciation; or

(X) Taxes paid on a party’s income by an employer or, if the income is nontaxable, the amount of taxes that would be paid if the income were taxable.

(2) For a parent subject to self-employment tax, 1/2 of Social Security and Medicare taxes due and payable on current income shall be deducted from the parent’s gross income before the child support obligation is computed.

(3) Alimony paid by either parent to the other parent subject to the support order shall be deducted from the gross income of the parent paying the alimony before the child support obligation is computed. Alimony received from any person, including alimony received from the other parent subject to the support order, shall be added to the gross income of the parent receiving the alimony before the child support obligation is computed. Deductions and additions for alimony shall be made regardless of whether the alimony is court ordered or paid pursuant to an agreement.

(4) A support order that is being paid by either parent shall be deducted from the parent’s gross income before the child support obligation is computed.

(5) Each parent shall receive a deduction from gross income for each child living in the parent’s home for whom the parent owes a legal duty to pay support, if the child is not subject to the support order. The amount of the deduction shall be calculated by determining the basic child support obligation for the additional child in the parent’s home pursuant to subsection (f)(2) of this section, using only the income of the parent entitled to the deduction. This figure shall be multiplied by 75%, and the resulting amount subtracted from the parent’s gross income before the child support obligation is computed.

(6) Gross income shall not include benefits received from means-tested public assistance programs, such as Temporary Assistance for Needy Families, Program on Work, Employment, and Responsibility, General Assistance for Children, Supplemental Security Income, or Food Stamps.

(7) Gross income shall not include income received by or on behalf of a child in the household of a parent or third-party custodian, including foster care and guardianship payments, if the income is for a child who is not subject to the support order.

(8) If a child subject to the support order is in the care of a third party, both parents may be required to pay child support. The income of the third party shall not be considered in the calculation of child support.

(9) If a child subject to the support order receives Social Security Disability Insurance (“SSDI”) derivative benefits through either parent, the amount of the derivative benefit paid to the child shall be included in the gross income of the parent from whom the benefit derives.

(10) If the judicial officer finds that a parent is voluntarily unemployed or underemployed as a result of the parent’s bad faith or deliberate effort to suppress income, to avoid or minimize the parent’s child support obligation, or to maximize the other parent’s obligation, the judicial officer may impute income to this parent and calculate the child support obligation based on the imputed income. The judicial officer shall not impute income to a parent who is physically or mentally unable to work or who is receiving means-tested public assistance benefits. The judicial officer shall issue written factual findings stating the reasons for imputing income at the specified amount.

(11) The judicial officer shall determine the adjusted gross income of each parent based on evidence, including pay stubs, tax returns, employer statements, affidavits, and oral testimony provided under oath.

(e) The judicial officer shall determine each parent’s adjusted gross income by making the additions to and deductions from gross income specified in subsection (d) of this section.

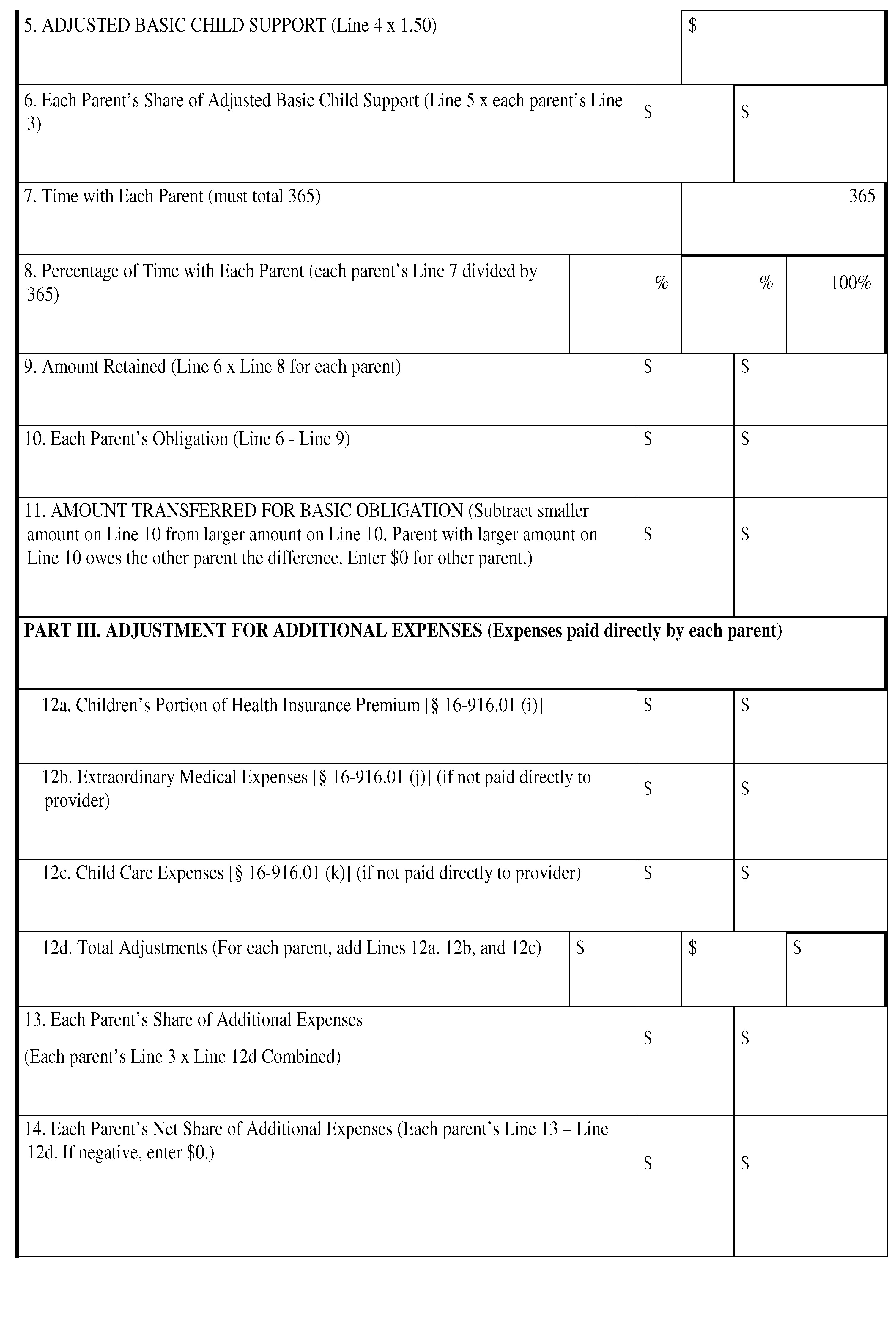

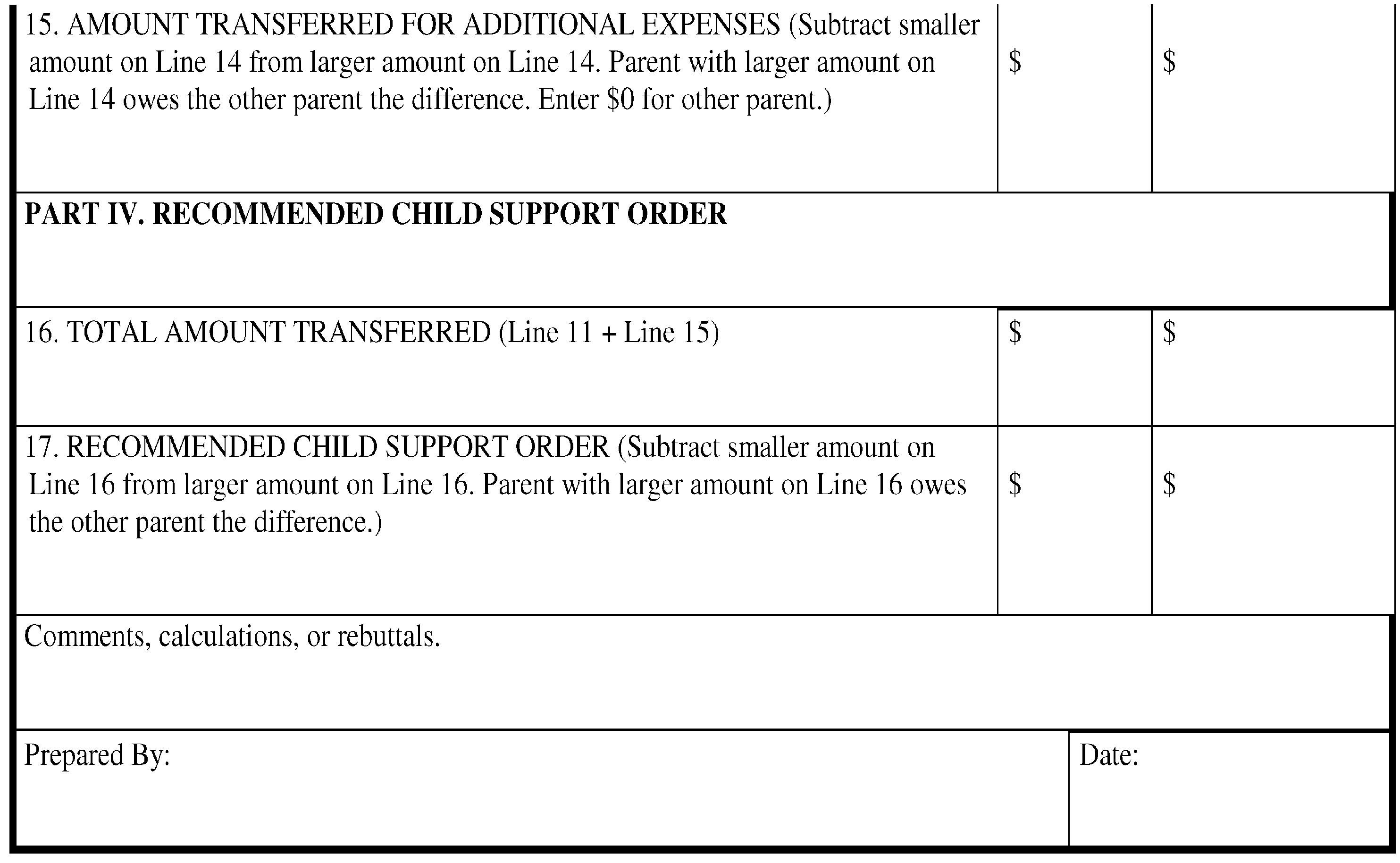

(f)(1) Except in cases of shared physical custody as described in subsection (q) of this section, the child support obligation shall be calculated according to the following procedure:

(A) Determine each parent’s adjusted gross income according to subsection (e) of this section.

(B) Using the parents’ combined adjusted gross income, locate the basic child support obligation from the Schedule of Basic Child Support Obligations referenced in subsection (w) of this section. If the parents’ combined adjusted gross income falls between the amounts shown in the schedule, the basic child support obligation shall be rounded up to the next higher amount.

(C) Calculate each parent’s percentage share of combined adjusted gross income by dividing each parent’s adjusted gross income by the combined adjusted gross income.

(D) Multiply the basic child support obligation from subparagraph (B) of this paragraph by each parent’s percentage share of combined adjusted gross income from subparagraph (C) of this paragraph to determine each parent’s share of the basic child support obligation. When the parents do not have shared physical custody as defined in subsection (q) of this section, the parent with whom the child does not primarily reside shall be the parent with a legal duty to pay support. The parent with a legal duty to pay support shall pay that parent’s share of the basic child support obligation to the parent with whom the child primarily resides. Adjustments for health insurance premiums, extraordinary medical expenses, child care expenses, and SSDI derivative benefits shall be made to this amount according to subsections (i) through (l) of this section. The parent with whom the child primarily resides shall be presumed to spend that parent’s own share of child support directly on the child.

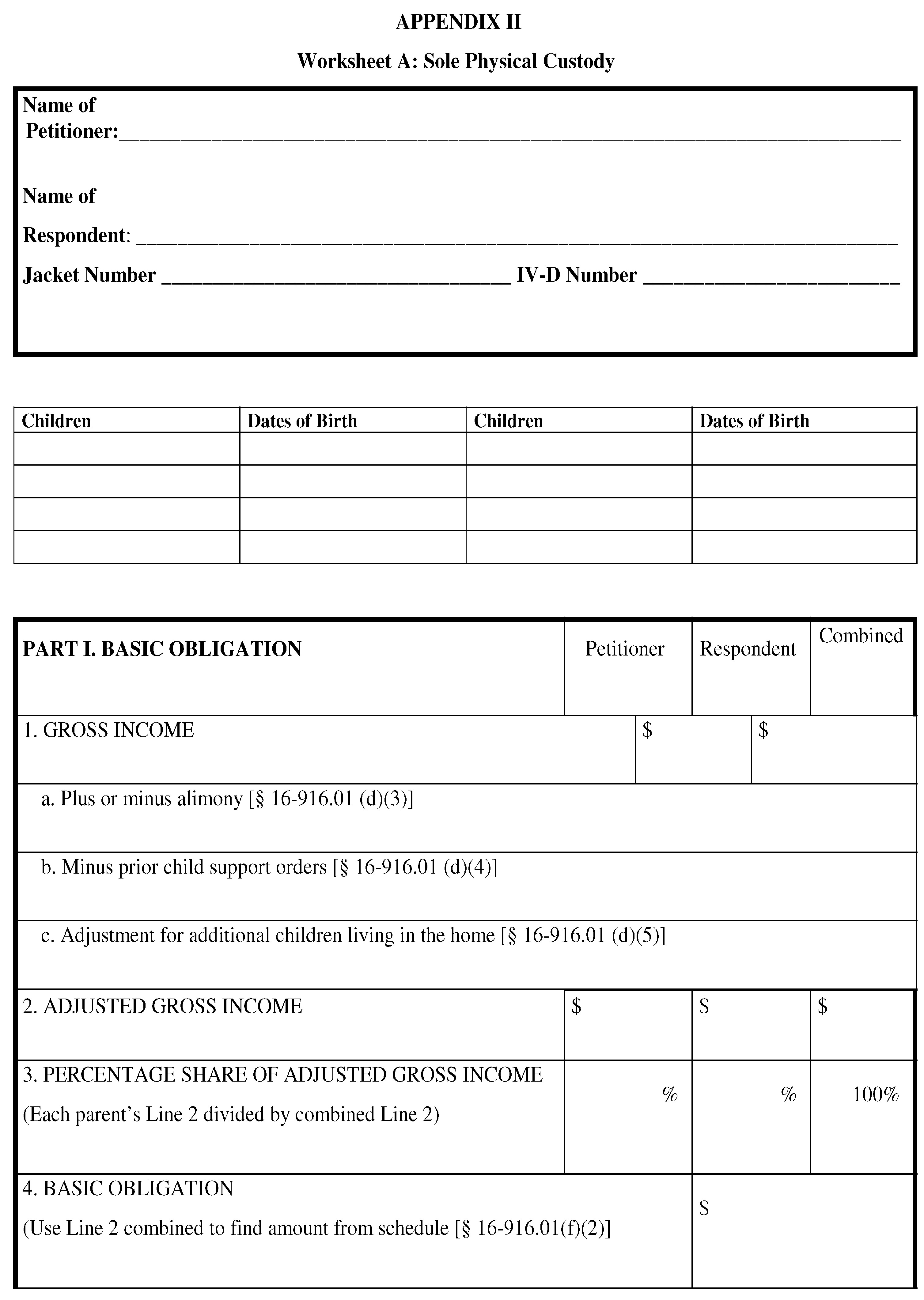

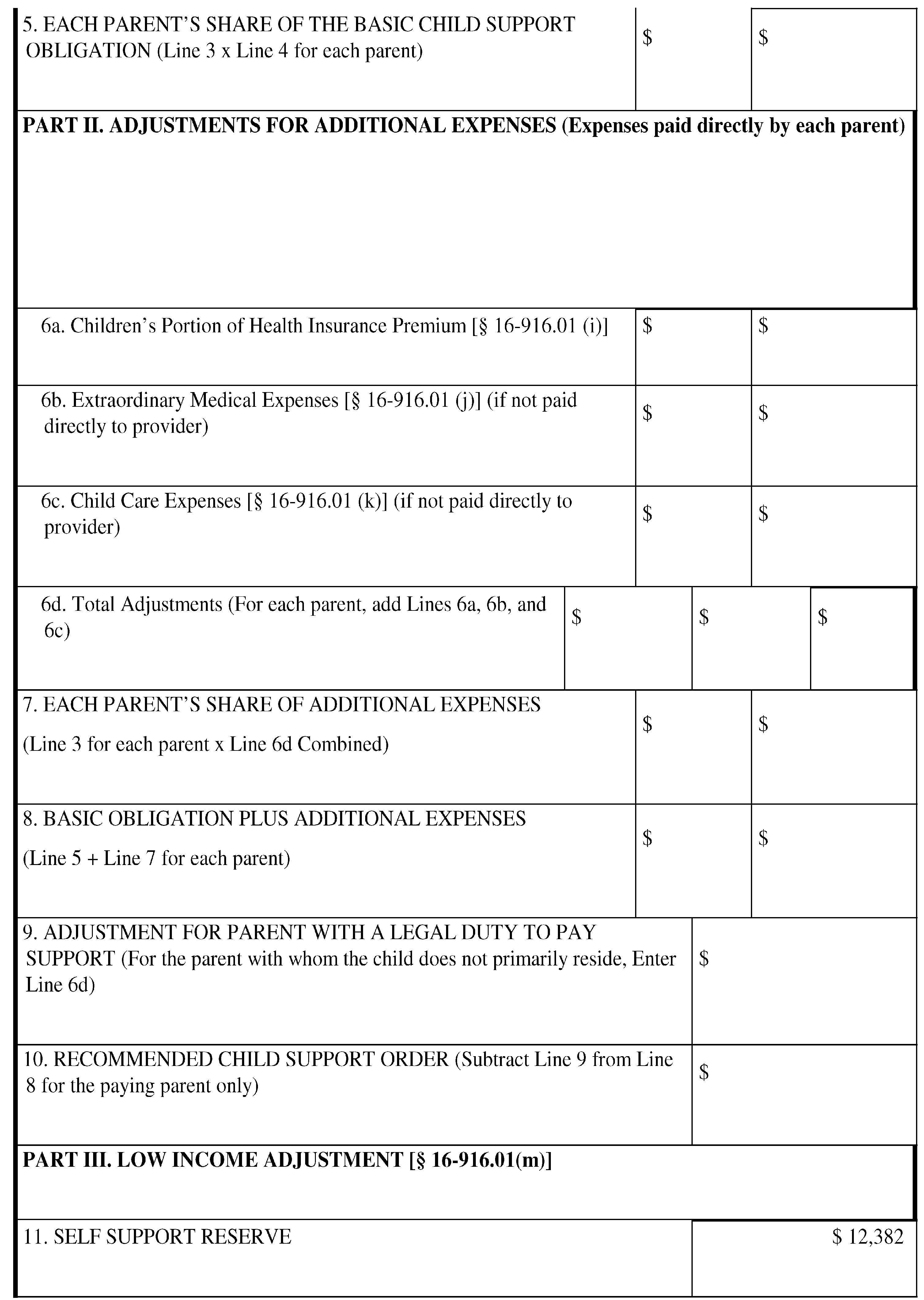

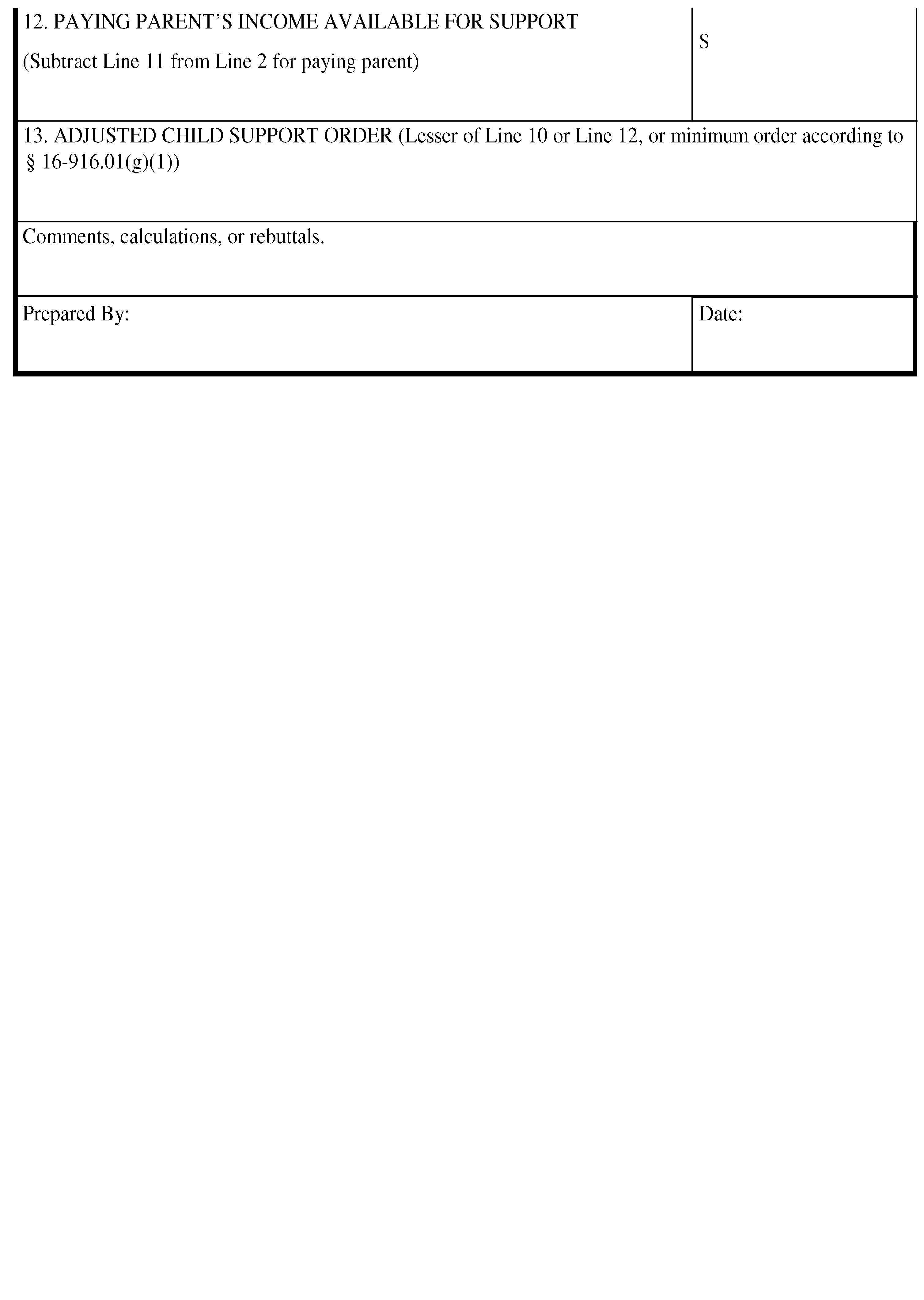

(2) Worksheet A in Appendix II may be used to calculate the child support obligation under this subsection.

(f-1)(1) If the judicial officer does not have sufficient evidence to determine the adjusted gross income of a parent with a legal duty to pay support in accordance with subsection (e) of this section, the judicial officer may enter a minimum order of $75 per month; provided, that the parent has:

(A) Been served with notice of the hearing but has failed to appear; or

(B) Failed to provide information about his or her gross income.

(2) If the judicial officer enters an order under this subsection, the judicial officer shall issue written factual findings stating the reasons for entering the order in the amount specified.

(g)(1)(A) A parent with a legal duty to pay support may maintain a self-support reserve as provided in this subsection. The self-support reserve shall be calculated at 133% of the United States Department of Health and Human Services poverty guideline per year for a single individual. The self-support reserve shall be updated by the Mayor every 2 years with the updated amount to be published in the District of Columbia Register and made effective as of April 1.

(B) As of April 1, 2007, the self-support reserve shall be $12,382.

(C) As of April 1, 2009, the self-support reserve shall be $14,404. The Child Support Services Division of the Office of the Attorney General shall act promptly to ensure that all child support orders entered into on or after April 1, 2009 are modified, as appropriate and as permitted under applicable law, to incorporate the April 1, 2009 adjustment.

(D) As of April 1, 2015, the self-support reserve shall be $15,654.

(2) A parent with a legal duty to pay support, but with adjusted gross income below the self-support reserve, shall be considered unable to contribute the amount determined under subsection (f) of this section. The judicial officer shall treat a parent at this level of income on an individual basis, and shall determine the amount that the parent is able to pay, while meeting personal subsistence needs.

(3)(A) Where the judicial officer finds that a parent with adjusted gross income below the self-support reserve has the ability to pay child support under paragraph (2) of this section, there shall be a presumption that the parent can pay a minimum amount of $75 per month, while meeting personal subsistence needs. The presumption may be rebutted downward to $0 or upward above $75 per month by evidence of resources or circumstances affecting the parent’s ability to pay, including age, employability, disability, homelessness, incarceration, inpatient substance abuse treatment, other inpatient treatment, housing expenses, provision or receipt of in-kind resources or services, benefits received from means-tested public assistance programs, other public benefits, subsidies, tax credits, or other appropriate circumstances.

(B) In any contested matter, the judicial officer shall ask the parent with a legal duty to pay support and the parent to whom support is owed, if present, if either has evidence that would rebut the presumption under subparagraph (A) of this paragraph. If either parent answers in the affirmative, that parent shall have an opportunity to present such evidence before an order is issued.

(C) The judicial officer shall issue written factual findings stating the reasons for the entry of an order below or above the $75 per month presumptive amount.

(g-1)(1) Upon request or on the judicial officer’s own motion, the judicial officer shall determine whether the parent to whom support is owed can meet his or her personal subsistence needs, considering the resources and circumstances of that parent, including age, employability, disability, homelessness, incarceration, inpatient substance abuse treatment, other inpatient treatment, housing expenses, provision or receipt of in-kind resources or services, benefits received from means-tested public assistance programs, other public benefits, subsidies, tax credits, or other appropriate circumstances.

(2) If the judicial officer determines that the parent to whom support is owed can meet his or her subsistence needs, the judicial officer shall order the parent with a legal duty to pay support to pay what he or she would otherwise be required to pay pursuant to this section.

(3) If the judicial officer determines that the parent to whom support is owed cannot meet his or her subsistence needs and the parent with a legal duty to pay support has an adjusted gross income below the self-support reserve under subsection (g) of this section, the judicial officer shall determine whether, for the support and maintenance of the child, the parent with a legal duty to pay support should pay more than he or she would otherwise be required to pay pursuant to subsection (g)(3) of this section.

(4) In no case shall the amount ordered pursuant to this section:

(A) Result in the adjusted gross income of the parent with a legal duty to pay support falling below the modified self-support reserve under subsection (g-2) of this section; or

(B) Exceed the amount of pass-through funds available to families receiving Temporary Assistance for Needy Families benefits.

(5) The judicial officer shall issue written factual findings stating the reasons for the entry of an order issued pursuant to paragraph (3) of this subsection.

(g-2) A modified self-support reserve shall be calculated at 100% of the United States Department of Health and Human Services poverty guideline per year for a single individual to be used to determine support pursuant to subsection (g-1) of this section. The modified self-support reserve shall be updated by the Mayor every 2 years with the updated amount to be published in the District of Columbia Register and made effective as of April 1. As of April 1, 2015, the modified self-support reserve shall be $11,770.

(h) The guideline shall not apply presumptively in cases where the parents’ combined adjusted gross income exceeds $240,000 per year. In these cases, the child support obligation shall not be less than the amount that the parent with a legal duty to pay support would have been ordered to pay if the guideline had been applied to combined adjusted gross income of $240,000. The judicial officer may exercise discretion to order more child support, after determining the reasonable needs of the child based on actual family experience. The judicial officer shall issue written factual findings stating the reasons for an award of additional child support.

(i)(1) All orders shall contain terms providing for the payment of medical expenses for the child in accordance with section 16-916.

(2) Amounts paid by either parent for health insurance premiums for a child subject to the support order shall be divided between the parents in proportion to their respective adjusted gross incomes and added to the parents’ respective shares of the basic child support obligation.

(3) A parent shall present proof of the increase in a health insurance premium incurred as a result of the addition of the child to the health insurance policy. The proof provided shall identify clearly that the source of the increase of the health insurance premium is the child subject to the support order. The cost to add the child shall be reasonable.

(4) If a parent has family health insurance coverage in the parent’s health insurance plan for a second family, the addition of the child who is subject to the support order need not result in an additional cost of health insurance coverage to the parent. The parent shall provide proof that the child has been added to the health insurance coverage. An adjustment shall not be made if there is no additional cost of health insurance coverage to the parent.

(5) Health insurance coverage shall be considered reasonable in cost if the cost to the obligated parent of providing coverage for the children subject to the support order pursuant to § 16-916.01(i)(3) does not exceed 5% of the parent’s gross income.

(j)(1) Extraordinary medical expenses are uninsured or unreimbursed medical expenses in excess of $250 per year, per child subject to the support order. These expenses include co-payments, deductibles, and contributions associated with public and private health insurance coverage, and costs that are reasonably necessary for orthodontia, dental treatment, asthma treatments, physical therapy, vision care, or the diagnosis or treatment of a health condition.

(2) Extraordinary medical expenses shall be divided between the parents in proportion to their respective adjusted gross incomes.

(3) If extraordinary medical expenses are recurring and the judicial officer can reasonably determine future expenses when the support order is established or modified, the judicial officer shall add each parent’s proportionate share of the expenses to the parent’s share of the basic child support obligation. The parents shall pay other extraordinary medical expenses in proportion to their adjusted gross incomes when these expenses are incurred. If either parent advances payment for these expenses to a provider of services, the other parent shall reimburse that parent for the other parent’s proportionate share of the expense within 30 days of receiving written proof of the expense and payment.